The Middle East is poised for a resurgence in mergers & acquisitions (M&A) activity, according to a CMS report.

Findings from the inaugural CMS Middle East M&A 2024/25 report, published in cooperation with Mergermarket, demonstrate a strong and stable M&A market at a high activity level.

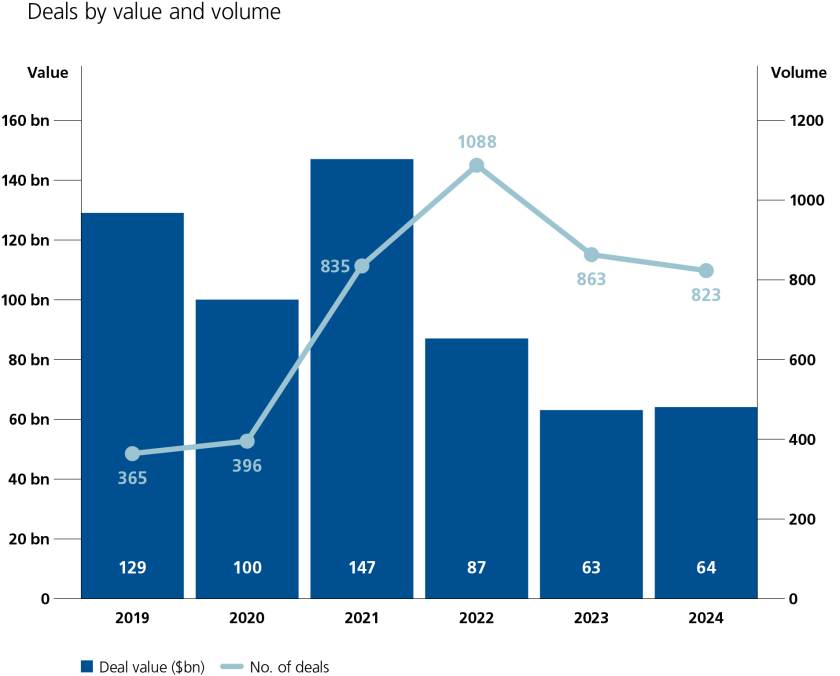

However, deal volume falls short of the post-Covid era in 2022, while overall value has remained under US$100 billion for the third consecutive year.

In 2024, the Middle East recorded 823 M&A deals, with a total value of approximately US$63.96 billion.

“We are waiting in anticipation for overall value to return to pre-Covid-19 levels,” said Graham Conlon, partner and Middle East corporate head at CMS. “Despite this, what we are seeing is that countries across the region are becoming mature markets and are attracting established investors and corporates. Sovereign wealth funds have continued to drive activity and are influencing the investment landscape as they seek to diversify their portfolios to implement national strategies.”

Sector dominance

The three biggest sectors by deal volume were technology, media & telecommunications (TMT), industrials & chemicals, and banking, according to the report.

TMT was the busiest sector last year with 227 deals (down from a high of 379 deals in 2022) and overall deal value of US$19.58 billion.

The second busiest sector, industrials & chemicals, experienced 110 deals and overall deal value of US$16.48 billion. Nearly half of these deals (52) were struck in Turkiye, underlining the importance of the sector for that market.

The banking sector recorded 70 deals in 2024, with significant transactions in the UAE, Bahrain, and Egypt.

Despite a relatively low number of deals (21), the oil & gas sector remained significant by deal value (US$16.66 billion). The region’s largest investment was Saudi Aramco’s $8.9 billion acquisition of a 22.5% stake in Rabigh Refining & Petrochemical Company.

Country-specific trends

The UAE remained the busiest M&A market in the GCC, with 130 deals worth US$11.68 billion in 2024. The TMT sector saw the most activity (32 deals), followed by business services (27 deals), and industrials & chemicals (13 deals).

Turkiye experienced its highest number of deals in more than half a decade. The country has seen steady growth in M&A activity with upward trajectory over the last five years, recording 260 deals up from 181 deals in 2021.

Saudi Arabia recorded 62 deals valued at US$15.19 billion. In contrast, Egypt saw a sharp decline in M&A activity, with only 29 deals in 2024 (compared to 71 in 2022) valued at US$1.3 billion (down from US$3.1 billion in 2022).

“The Middle East is poised for a resurgence in M&A activity, driven by economic diversification, technological advancements, and favourable macroeconomic conditions,” said Patrik Daintry, corporate partner at CMS, UAE. “Sectors such as technology, fintech, energy and financial services are expected to see significant growth as the region continues to modernise and innovate. The positive sentiment among dealmakers globally, and the region’s strategic initiatives, create a fertile ground for strategic acquisitions and investments, making the Middle East a key player in the global M&A landscape.”